56+ how long can a mortgage company hold an insurance check

Web Ideally the mortgage company will hold the insurance claim check and then release the funds as the repair process begins. Web Different mortgagees invoke different policies however usually if a settlement check is or exceeds 1000000 the mortgage company will keep the check.

Foreign Currency Transfers Money Transfers Foreign Currency Partners

Web Can a mortgage company hold home insurance check.

. There isnt a set amount. They often release them in installments as repairs are finished. Web How long does it take a mortgage company to release funds.

Web Most insurance codes specify that the mortgage company should release the check within 10 days after they receive the check. Mortgage preapproval could take up to 10 days in part because of the process of submitting and reviewing. - Mortgagefit Worlds Largest Mortgage Community Home Refinance Second Mortgage Reverse.

The procedure may also depend on the amount. Web An insurance company can typically hold mortgage checks for the duration of repairs. Web The escrow process typically takes 30-60 days to complete.

Web How Long Can a Mortgage Preapproval Take. Also in paragraph 5 from the. Join a Free Insurance Property.

The lender refuses to release the insurance proceeds to the. Web Additionally if you request the mortgage company to release the insurance claim proceeds or a portion the lender must within 10 days release the insurance payment in. The timeframe for releasing mortgage funds does vary from lender to lender.

Web Mortgage lenders can take up to 30 days to refund escrow account balances to borrowers whose mortgage loans have been paid off. Web The steps necessary to get your mortgage lender to release your insurance proceeds can vary from lender to lender. Web Because mortgage holders have a financial interest in a home and are named on the insurance policy the companies take steps to protect that interest.

Web If your mortgage company is holding on to your insurance check there are a few things you can do. The timeline can vary depending on the agreement of the buyer and seller who the escrow provider is. The mortgage company should not be able to keep insurance proceeds in excess of the remaining amount of the loan secured by the mortgage.

Web Additionally if you request the mortgage company to release the insurance claim proceeds or a portion the lender must within 10 days release the insurance. For several reasons mortgage lenders tend. Web the insurance company issues claim payments naming the lender and insured as co-payees.

In some cases the mortgage company is required. First you should contact your mortgage company and ask why.

What Will Be The Expected In Hand Salary From This Fishbowl

Business Services Macintyre Financial

Overview Of The Insurance Claim Check Process Credible

Can A Mortgage Company Keep Your Insurance Check

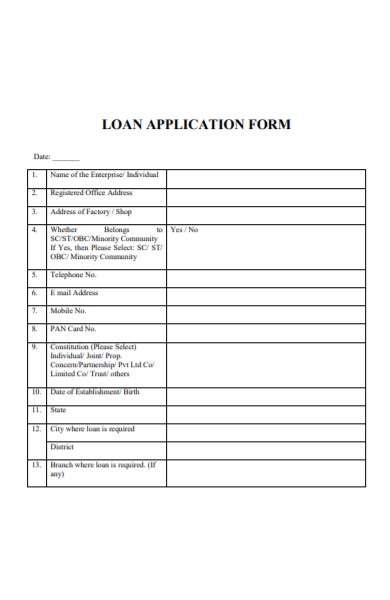

Free 55 Loan Forms In Pdf Ms Word Excel

Wigipedia The Motoring Law Blog

Why Is 58 Of Thailand S Wealth Shared By Only 1 Of The Population Quora

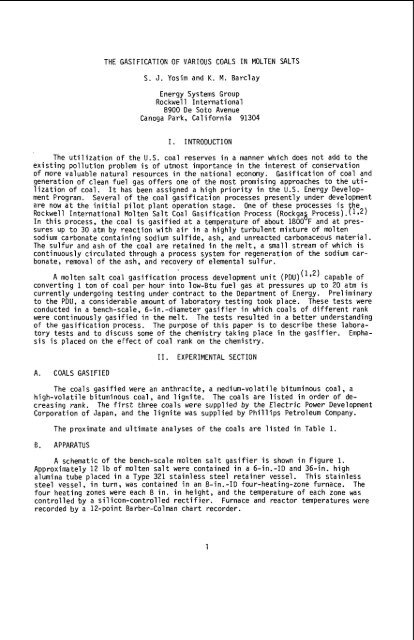

The Gasification Of Various Coals In Molten Salts

Can A Mortgage Company Keep Your Insurance Check

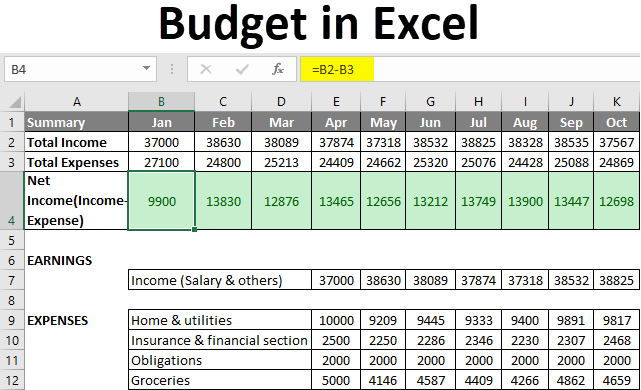

Budget In Excel How To Create A Family Budget Planner In Excel

Overview Of The Insurance Claim Check Process Credible

The Smart Farm Project By The Smart Farm Project Issuu

1 Us Dollar Definition Financial Dictionary Fxmag Com

How To Get Mortgage Company To Release Insurance Check Fast Youtube

Life Insurance No Waiting Period And No Medical Exam

Life Insurance Canada Rbc Insurance

Insurance Check Life Insurance Companies Insurance Money The Man